In our July 2021 web cast for Dimensional (Bringing the Matrix Book to Life), T.J. and I discussed risk tolerance questionnaires and a particular “flaw” that can block investors from reaching their goals. I can illustrate this using the Index Matrix app.

Let’s say a particular client indicates on a risk questionnaire that he or she cannot tolerate a 30% portfolio decline in any given year. This is almost always a fear-based response, not one based on expected withdrawals from the portfolio. In other words, long-term investors with diversified asset class portfolios–especially those with a high-quality, short-term bond allocation can tolerate a 30% decline if they don’t allow fear to derail their plan.

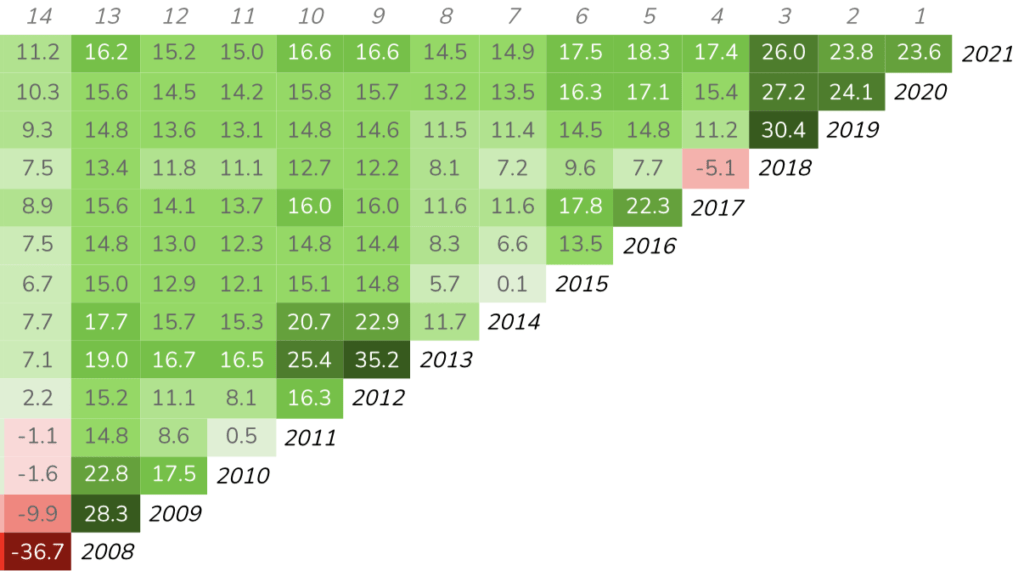

Below is a screenshot from the Index Matrix app for the period 2008-2021. The -36.7% return for the US total stock market in 2008 was a serious gut punch. But what we also see is that investors who did not panic and sell were positioned to realize an 11.2% compound rate of return (before costs) on those assets. Assets added the next year have compounded at 16.2%. This is an especially important perspective for 401(k) investors.

It’s important to understand the underlying principles here, since this illustration is based on an index (Fama/French US Market) and assumes performance starting on day one each year. Returns will always be different under different circumstances. But you get the point.